Rank: 1

Bitcoin halving is an integral process built into the operation of Bitcoin that ensures the digital currency remains scarce and resists inflation. Occurring approximately every four years, halving reduces the reward that Bitcoin miners receive for verifying transactions and adding new blocks to the blockchain. This planned reduction is programmed into Bitcoin’s source code and has occurred since the cryptocurrency’s inception in 2009, fundamentally affecting the supply of new coins entering the market.

The concept of halving plays a critical role in Bitcoin’s economic model. With a finite supply capped at 21 million coins, halving events slow down the rate at which new bitcoins are created and, consequently, how quickly the total supply approaches this cap. This event is watched closely by investors, traders, and economists as it can influence Bitcoin’s price and the broader cryptocurrency market. It is also an essential factor for miners, who must assess the impact of reduced rewards on their operations.

Key Takeaways

- Halving decreases miner rewards, contributing to Bitcoin’s scarcity.

- It is an anticipated event that can affect Bitcoin’s market value.

- Halvings are predetermined and influence the long-term economics of Bitcoin.

Bitcoin Halving Fundamentals

Bitcoin halving is a critical event in the cryptocurrency sector that directly influences Bitcoin’s supply, miners’ rewards, and market dynamics. This section unpacks the essential facets of Bitcoin halving and its place within blockchain technology.

What Is Bitcoin Halving?

Bitcoin halving refers to the event where the reward for mining new blocks is halved, therefore reducing the rate at which new bitcoins are generated. This halving happens approximately every four years, after 210,000 blocks are mined. The process will continue until the maximum supply of 21 million bitcoins is reached.

Basic Principles of Blockchain Technology

Blockchain technology is the foundational component of the cryptocurrency market. It operates as a distributed ledger, recording transactions across a network of computers. The ledger is updated by miners who validate and add new transactions to the blockchain. This secured and decentralised design ensures that transactions are transparent and immutable.

The Role of Miners in the Network

Miners play a pivotal role in the function of the Bitcoin network. They utilise powerful computers to solve complex cryptographic puzzles, a process vital for the addition of new blocks to the blockchain. Upon successfully adding a block, miners receive Bitcoin as a reward, providing an incentive to maintain network security and transaction verification.

Supply and Demand Effects

The concept of supply and demand is a driving force in the valuation of bitcoin. Halving events, by reducing the reward miners receive, directly decrease the rate at which new bitcoins are supplied to the market, potentially leading to an increase in price if demand remains stable or grows. This event is watched closely by investors, as it may play a role in influencing Bitcoin’s market price.

Historical Overview and Halving Events

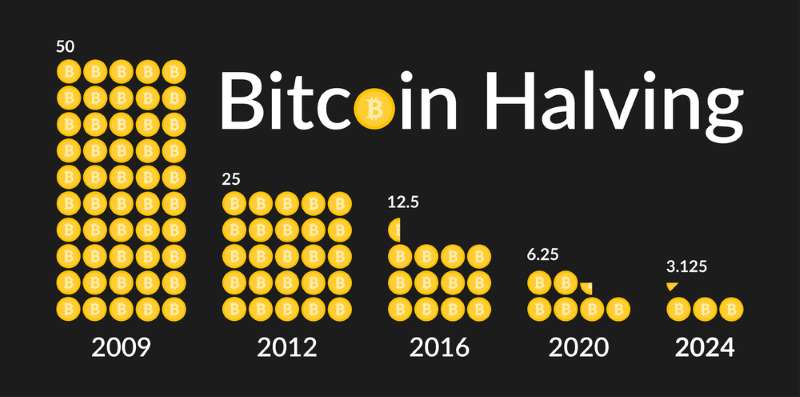

Bitcoin halving events are integral to its supply mechanics, with each halving reducing the block reward by 50%. These events happen approximately every four years, playing a significant role in Bitcoin’s supply and perceived value.

Previous Bitcoin Halvings

First Halving – 2012: The initial halving occurred in November 2012, reducing the block reward from 50 to 25 bitcoins. This marked the first test of Bitcoin’s deflationary economic model.

Second Halving – 2016: Four years later, in July 2016, the block reward was halved again to 12.5 bitcoins, continuing the protocol’s design to decrease new bitcoin supply over time.

Third Halving – 2020: In May 2020, the most recent halving to date, the block reward dropped from 12.5 to 6.25 bitcoins, in line with the core philosophy of reducing new issuance.

Significant Dates and Halving Cycles

- 2012 Halving: November 28, 2012 – The block reward went from 50 to 25 bitcoins.

- 2016 Halving: July 9, 2016 – The block reward was further reduced to 12.5 bitcoins.

- 2020 Halving: May 11, 2020 – The latest halving decreased the block reward to 6.25 bitcoins.

Each cycle has traditionally stimulated conversation regarding Bitcoin’s scarcity and long-term value. While past performance is not indicative of future results, historical trends show a marked increase in Bitcoin’s price following halving events, although several external factors also influence market movement. The next expected halving is in April 2024, which will likely see the block reward drop to 3.125 bitcoins.

Economic Implications of Halving

The Bitcoin halving is a seminal event that notably impacts the cryptocurrency’s economic nuances, primarily through its influence on supply, inflation rates and the subsequent reactions in market sentiment and value proposition.

Impact on Bitcoin’s Value Proposition

Halvings amplify Bitcoin’s scarcity by reducing the reward that miners receive for adding new blocks to the blockchain. It reinforces Bitcoin’s value proposition as a digital asset with a supply limit. This programmed scarcity can be likened to that of precious metals, where a reduction in supply can augment value, assuming demand stays constant or increases.

Inflation Rate and Bitcoin as Digital Gold

Bitcoin is often dubbed the ‘digital gold’, owing to its deflationary asset qualities. Unlike fiat currencies that can be printed at the will of central banks, Bitcoin’s inflation rate is algorithmically set to decrease over time. This means after every halving, fewer new Bitcoins are created, thus potentially lowering the inflation rate and mimicking the hoarding quality of gold.

Market Sentiment and Investment Perspectives

Market sentiment around the time of a halving can reach optimistic heights in anticipation of potential price increases. Investors might view the event as a positive occurrence based on historical precedents where halvings have been followed by price surges. However, this is not a guaranteed trend, and the market’s reaction can vary.

Comparative Analysis With Fiat Currencies and Gold

Comparatively, fiat currencies are susceptible to devaluation through inflation, whereas Bitcoin’s design aims for a decreasing inflation trajectory. This pits Bitcoin as a possible counterbalance to fiat currencies in an investment portfolio. In alignment with gold, Bitcoin is seen as having the ability to act as a hedge against inflation due its capped supply.

Mining Mechanics and Rewards

Bitcoin mining is an essential process for the network, providing both transaction validation and currency issuance. It involves solving complex cryptographic puzzles, for which miners are rewarded with new bitcoins. This incentive system ensures the ongoing security and operational viability of the Bitcoin blockchain.

Mining Process and Rewards Structure

The mining process requires highly specialised hardware, known as ASICs, which perform calculations to find a new block. Successful miners who discover a new block are granted block rewards, which comprise new bitcoins and transaction fees from all transactions included in the block. Initially, the block reward was 50 bitcoins per block; however, it is designed to halve every 210,000 blocks, approximately every four years.

Changes in Block Rewards Over Time

| Halving Event | Block Reward | Year |

|---|---|---|

| Original Reward | 50 BTC | 2009 |

| 1st Halving | 25 BTC | 2012 |

| 2nd Halving | 12.5 BTC | 2016 |

| 3rd Halving | 6.25 BTC | 2020 |

| 4th Halving (Upcoming) | 3.125 BTC | 2024 |

The block reward is a critical component of Bitcoin’s economic model, influencing the rate of new bitcoin issuance. With each halving, the block reward diminishes, reducing the rate at which new bitcoins enter circulation. The most recent halving in 2020 cut the block reward to 6.25 bitcoins, and the next halving in 2024 is expected to reduce it further to 3.125 bitcoins.

Mining Profitability and Costs

Mining profitability hinges on the balance between the block reward and the operational costs, primarily electricity and mining hardware. Miners seek regions with lower electricity prices and invest in energy-efficient hardware to maximise margins. As the block reward decreases with each halving, mining profitability can be challenged, potentially leading to a consolidation of mining power among entities with lower-cost structures.

Network and Technology Aspects

The technology behind Bitcoin is a complex interplay of cryptography, computer science, and economic principles designed to maintain network security, manage mining difficulties, and enforce the proof-of-work mechanism.

Security and Decentralisation of the Bitcoin Network

Bitcoin’s network security is upheld through decentralisation. Thousands of independent nodes, distributed globally, work together to verify transactions and add them to the blockchain. Decentralisation ensures no single entity can control the network or alter its transaction history, reinforcing trust in the Bitcoin system.

Mining Difficulties and Hash Rate Fluctuations

Bitcoin’s mining difficulty adjusts every 2,016 blocks, roughly every two weeks, to maintain a consistent block time, which is critical for the network’s stability. The hash rate, the measure of computational power per second used when mining, naturally fluctuates as miners enter or exit the network and as the difficulty adjusts to keep block times steady.

The Significance of Proof-of-Work and Nodes

Proof-of-work is the consensus algorithm Bitcoin uses to add new blocks to the blockchain. Miners solve complex mathematical puzzles, and the first to do so can add a block and receive Bitcoin as a reward. This process is not only integral to introducing new bitcoins but also to the validation and relay of transactions by nodes across the network, keeping it robust and secure.

Market Effects and Price Behaviour

The Bitcoin halving is an event that significantly impacts the market dynamics of Bitcoin by altering supply, which in turn can lead to price fluctuations and long-term changes in market behaviour.

Price Fluctuations Post-Halving

Following a Bitcoin halving, the immediate response often includes price fluctuations as traders and long-term investors adjust their strategies. Historically, Bitcoin has experienced a price increase in the months following a halving, although the magnitude and timing of these increases vary. For instance, the market might anticipate the reduced supply and price may rise in anticipation, but it can also correct due to other market forces.

- Historical post-halving increases:

- Halving 1: Price increased over the next year

- Halving 2: Price rose leading up to the event

- Halving 3: Slower growth, but steady upward trend

- Halving 4: Predicted growth remains speculative before the event

Volatility and Long-Term Trends

Volatility is inherent in the cryptocurrency market, and the Bitcoin halving events are no exception. However, investors consider the halving as a positive long-term indicator because it reduces the rate at which new BTC is generated, potentially increasing scarcity. The long-term trend has generally been bullish following halving events, yet this trend should not obscure the short-term volatility that can test the resolve of even seasoned traders.

- Volatility patterns:

- Pre-Halving: Increased trading activity and speculation

- Post-Halving: Sharp movements, quick corrections

Trading Strategies and Speculation

For traders and speculators, the anticipation of a halving event often leads to increased trading activity. Some may aim to capitalise on short-term price movements, while long-term investors may adjust their holdings in anticipation of potential price increases in the months or years following the halving. Trading strategies can range from conservative holding to active trading, depending on risk tolerance and market perception.

- Trading approaches:

- Short-Term: High-frequency trading, capitalising on volatility

- Long-Term: Holding to potentially benefit from appreciated value

Future of Bitcoin and Cryptocurrencies

In considering the future of Bitcoin and cryptocurrencies, three key areas come to the fore: the timelines of future halving events, the ramifications of Bitcoin’s final coin being mined, and the ongoing adaptation within the crypto ecosystem and its underlying technologies.

Projection of Future Halvings

Bitcoin halving, a programmed reduction in the block rewards for miners, is an event that typically occurs every four years. As of 2024, the reward has halved from 6.25 BTC to 3.125 BTC per block. Moving forward, these halvings will continue until the maximum supply of 21 million bitcoins is in circulation, setting a precedent for a deflationary currency model.

Future halving dates can only be estimated due to the variable rate of block creation. Assuming a stable rate, the next halving is anticipated to happen in 2028, when the block reward will be reduced to 1.5625 BTC.

Consequences of the Last Bitcoin Being Mined

The final Bitcoin is expected to be mined in the year 2140, after which no new bitcoins will enter circulation. This event will likely have significant impacts on miners, who will then rely solely on transaction fees for compensation. With the cessation of new bitcoin creation, the market may experience a shift in dynamics, emphasizing scarcity and potentially affecting the asset’s value.

The fixed supply of Bitcoin contrasts with traditional fiat currencies, which can be inflated indefinitely. This scarcity could elevate Bitcoin’s status as a digital store of value, akin to digital gold.

Evolution of the Cryptocurrency Ecosystem and Technologies

The cryptocurrency ecosystem is poised for ongoing evolution, both technologically and in terms of market maturation. Technological advancements, such as the development of second-layer protocols like the Lightning Network, aim to address concerns like scalability and transaction speed.

Furthermore, as traditional finance increasingly intersects with cryptocurrencies, one can expect the proliferation of more sophisticated financial instruments based on cryptocurrencies. The intersection with emerging technologies like quantum computing and AI could also introduce new security paradigms and use cases for blockchain technology.

Regulatory frameworks will likely play a pivotal role in shaping the cryptocurrency landscape. As governments and financial institutions understand and adapt to cryptocurrencies, these regulations may provide clarity and stability, fostering an environment conducive to innovation and growth.

Regulatory and Societal Impact

Bitcoin Halving has implications that extend beyond the cryptocurrency market and into the realms of government and central bank policies, as well as societal adoption of Bitcoin as a currency and asset.

Government and Central Bank Perspectives

Governments and central banks view Bitcoin’s halving events with a mix of caution and interest. The reduction in Bitcoin supply growth caused by the halving could place it in a category that central banks monitor, given their mandate to manage national monetary policy. Central banks, which traditionally control the supply of money, may consider Bitcoin’s deflationary nature when designing their policy responses. Additionally, they are attentive to the potential for Bitcoin to serve as a hedge against inflationary pressures in the traditional fiat currency system.

Transaction Fees: As block rewards decrease post-halving, miners may place greater emphasis on transaction fees to sustain profitability. This could lead to an increase in transaction costs on the Bitcoin network, prompting governments to scrutinise the efficiency and viability of Bitcoin as a transaction method.

Bitcoin’s Role as a Transaction Method and Store of Value

The perception of Bitcoin as a payment method and store of value plays a significant role in its societal impact.

Store of Value: Bitcoin is often touted as a store of value, akin to digital gold, especially in a post-halving context where reduced supply growth can theoretically enhance its scarcity and value retention. Societal trust in Bitcoin in this role could influence its adoption levels and regulatory responses.

Payment Method: The use of Bitcoin for everyday transactions hinges on its adoption by both businesses and individuals. When transaction fees increase due to halving events, the attractiveness of Bitcoin as a payment method may be affected. However, continuous improvements in technology and payment processing could mitigate fee-related concerns, influencing societal acceptance of Bitcoin as a viable alternative to traditional payment systems.

Challenges and Risks

This section examines specific challenges and risks associated with Bitcoin halving, particularly the centralisation of mining power and various risk factors that necessitate effective risk management.

Centralisation of Mining Power

One significant challenge of the Bitcoin halving event is the potential centralisation of mining power. As block rewards halve, only miners with efficient operations and low costs can sustain profitability, leading to a concentration of mining power among larger players. This centralisation poses a threat to the decentralised ethos of the Bitcoin network, potentially making it more susceptible to censorship and coordinated attacks.

Risk Factors and the Importance of Risk Management

Bitcoin halving introduces several risk factors that must be diligently managed. Price volatility often precedes and follows a halving event, influenced by speculative trading and miner behaviour. Furthermore, miners may face liquidity issues as their income diminishes, which might lead them to sell off holdings, impacting Bitcoin’s price. Central banks’ monetary policies might indirectly affect Bitcoin’s market as investors look for alternative stores of value. Effective risk management strategies are crucial in navigating the complex interplay of these dynamics.

Frequently Asked Questions

This section addresses common questions surrounding Bitcoin halvings, providing insight into their effects on market price, historical significance, and the mining process.

How does a Bitcoin halving impact the market price?

A Bitcoin halving typically reduces the rate at which new coins are created, which can lead to an increased demand if the supply of Bitcoin is constricted. Historically, this event has preceded a rise in Bitcoin’s market price due to the potential scarcity.

What is the historical significance of Bitcoin halvings?

Bitcoin halvings are significant as they are built into Bitcoin’s deflationary economic model. Each halving reduces the reward for mining new blocks, which has historically been followed by periods of increased Bitcoin prices as the available supply tightens.

In what ways could Bitcoin’s upcoming halving influence future price predictions?

The upcoming Bitcoin halving might be factored into future price predictions by creating expectations of reduced supply and potential price increases. Analysts may also consider past halving events and their impact on prices when making forecasts.

Can you explain the process and purpose behind Bitcoin halvings?

The process of Bitcoin halving occurs every 210,000 blocks, reducing the rewards miners receive for adding new blocks to the blockchain. The purpose is to control inflation by halving the rate at which new Bitcoins are introduced to the market.

What are the potential effects of Bitcoin halving on mining and miner profitability?

Bitcoin halving can decrease miner profitability by reducing the block reward. Miners might need to increase efficiency, seek cheaper energy sources, or rely on transaction fees to sustain their operations.

How have previous Bitcoin halvings affected its perceived investment value?

Previous Bitcoin halvings have bolstered its perceived investment value by creating a narrative of scarcity and potential appreciation in price. This perception may draw more long-term investors interested in digital assets with limited supply.